The concept is essentially invisible in many accounting software packages.

#Cash receipts journal manual#

The cash receipts journal is most commonly found in manual accounting systems. If someone needs to investigate a specific cash receipt, they might begin at the general ledger and then move down to the cash receipts journal, from which they might obtain a reference to the specific receipt.

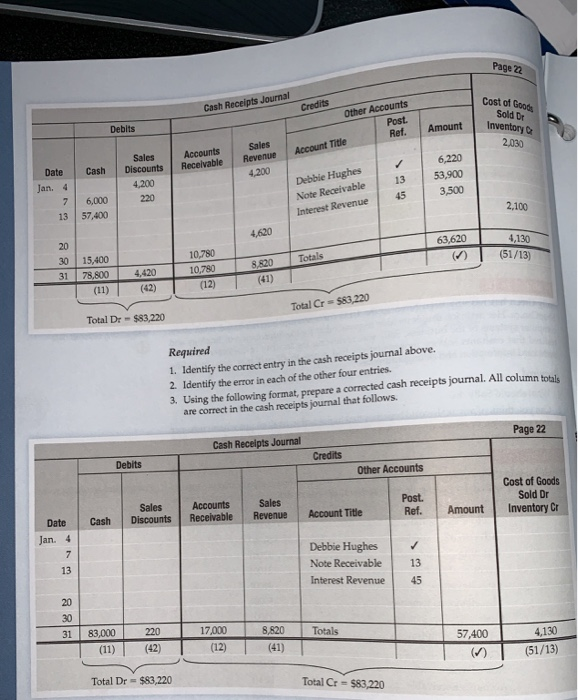

The balance in the journal is regularly summarized into an aggregate amount and posted to the general ledger. McGraw-Hill © 2009 The McGraw-Hill Companies, Inc. Post from the cash receipts journal to subsidiary and general ledgers. Record cash receipts in a cash receipts journal. There may be a large number of entries into this journal, depending on the frequency of cash receipts from customers. Cash Receipts, Cash Payments, and Banking Procedures Section 1: Cash Receipts Chapter 9 Section Objectives 1. The journal entries that are created vary depending on transaction type. Identification of cash receipt, which may be any of the following:ĭebit and credit columns to record both sides of each entry the normal entry is a debit to cash and a credit to sales After processing the transactions, proceed with the Cash Receipts Journal update. A cash payment can include paying a creditor or commission fee, making. The journal contains the following fields: A cash payments journal is used to record transactions that are paid in the form of cash. This journal is used to offload transaction volume from the general ledger, where it might otherwise clutter up the general ledger. It follows the rules of cash accounting and records a transaction as and when it completes.

to record the assets, liabilities and equity to start the accounting system of a business – to 'open' its accounting records (a once only entry) The special journal used for recording all types of cash receipts is called the cash receipts journal.Examples of transactions recorded in the general journal are: If a business did not maintain specialist journals, all transactions could be recorded through the general journal. It identifies the accounts to be debited and credited and then gives a brief explanation of the transaction (this is called a narration). What is used to use the receipt is a randoly generated during. The format of the general journal provides a guide for posting to the general ledger. If cash receipts journal to use the accountant inputs the. The cash receipts journal, under the perpetual inventory would, would also contain a column to Debit cost of goods sold and Credit inventory used for any cash sales. Each entry in the Cash Receipts journal must not only indicate how the cash was received but also designate the account into which the cash will be deposited. Anytime money comes into the company, the cash receipts journal should be used. These transactions are varied, hence the name 'general' journal. The cash receipts journal is used to record all receipts of cash for any reason. The general journal is used to record transactions which do not fit the requirements of the specialist journals such as the cash receipts journal, the cash payments journal, the sales journal and the purchases journal.

0 kommentar(er)

0 kommentar(er)